The portfolio

In 2022, I created a portfolio of stocks that I thought could beat the market. I averaged into this portfolio throughout 2022, contributing just under $9,000 between January and October 2022. The portfolio was split into two groups - Group A and Group B.

Group A was comprised of my 6 highest conviction stocks: Tesla TSLA 0.00%↑ , Hubspot HUBS 0.00%↑ , Square (Block) SQ 0.00%↑ , Shopify SHOP 0.00%↑ , Zoom ZM 0.00%↑ , and Etsy ETSY 0.00%↑.

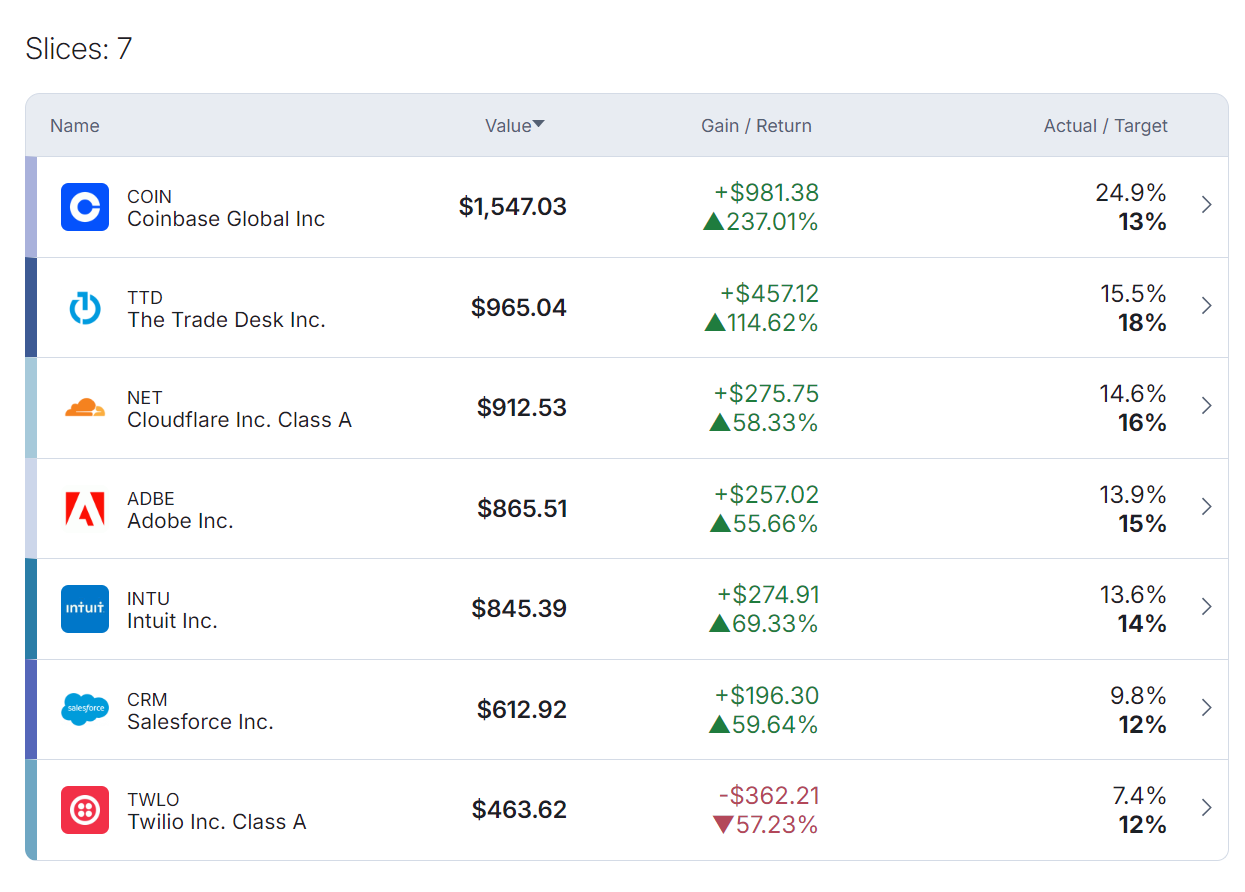

Group B was made up of stocks I liked, but wasn’t as confident in: Coinbase COIN 0.00%↑, The Trade Desk TTD 0.00%↑, Cloudflare NET 0.00%↑, Adobe ADBE 0.00%↑, Intuit INTU 0.00%↑, Salesforce CRM 0.00%↑, and Twilio TWLO 0.00%↑.

You’ll notice that this portfolio excludes key mega cap stocks such as Apple AAPL 0.00%↑ , Amazon AMZN 0.00%↑, Google GOOGL 0.00%↑, and Facebook META 0.00%↑. Mega caps have performed exceptionally well over the last two years, so it’s reasonable to assert that they should have been included. No doubt if they’d been included my portfolio would have achieved better returns. The reason I did not include these names is twofold:

I already own them in my main portfolio, and they are already a substantial of my overall investments.

My thesis in 2022 was that mid & large cap tech stocks were beaten down and oversold due to interest rate hikes, and that they would outperform mega cap tech going forward.

So it is fair to say that excluding mega cap tech was a mistake in hindsight, but it doesn’t negate the fact that I believed this portfolio could beat the market, and had legitimate reasons for why I believed so. So far I have been proven wrong, but I wanted to share the reasoning behind my decision to exclude mega caps.

Results

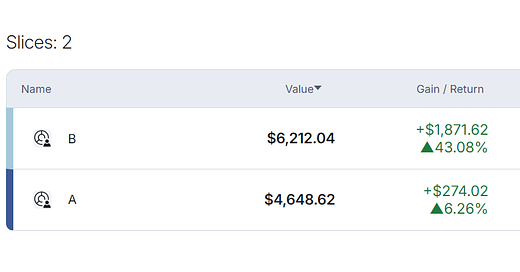

Now, looking back two years later, what is fascinating is the performance difference between Group A and B. If I had only purchased the stocks in Group A, my highest conviction picks, my portfolio would be up just 6% since inception. If I had only purchased the stocks in Group B, I’d be up 43%. In aggregate, the portfolio is up a respectable 26% in two years.

My takeaways: I did not successfully pick winners, and diversification was the thing that allowed me to achieve a reasonable return.

But more importantly - I didn’t beat the market. Had I invested the entire portfolio in the S&P500 SPY 0.00%↑ in July 2022, I would have achieved a 42% return vs. the 26% I achieved over the two year period.

So what happened? The results are fascinating. The stocks I was less confident in outperformed the stocks I had the most conviction in, and the stocks I was less confident in actually did beat the market. But what’s most important is if you look at the portfolio as a total, it underperformed the market. What can we learn from this? It is very difficult to pick stocks and beat the market.

Here is the entire portfolio in aggregate:

Performance Breakdown

Group A - Highest Conviction

Group B - Lower conviction

Conclusion

You may be a brilliant investor and stock picker. You may see my stock picks as foolish. Granted, my portfolio is almost exclusively US based tech equities, so I was diverse in my picks within the technology sector, but not diversified in terms of asset class, sectors, and geography.

However, you might be like me - someone who is relatively financially savvy and interested in investing in individual companies. Investing in individual stocks is tempting. Let’s be honest - it’s exciting to pick stocks, and we all want to beat the market. The question is, can you do it successfully? If you’re me, you’ve learned that you likely cannot beat the market, and as a result, it’s probably not worth trying.

I plan to keep this portfolio intact as an ongoing experiment, and I’ll provide updates on its progress over time. I am shifting my strategy almost exclusively to broad market index funds as I believe this will help me achieve the highest long term returns.

I hope this is helpful for you on your investing journey. Good luck out there.